Having performed financial evaluations for various-sized organisations, I have created a comprehensive generalised list of fundamental business economic formulae that one could use to measure a business’s performance.

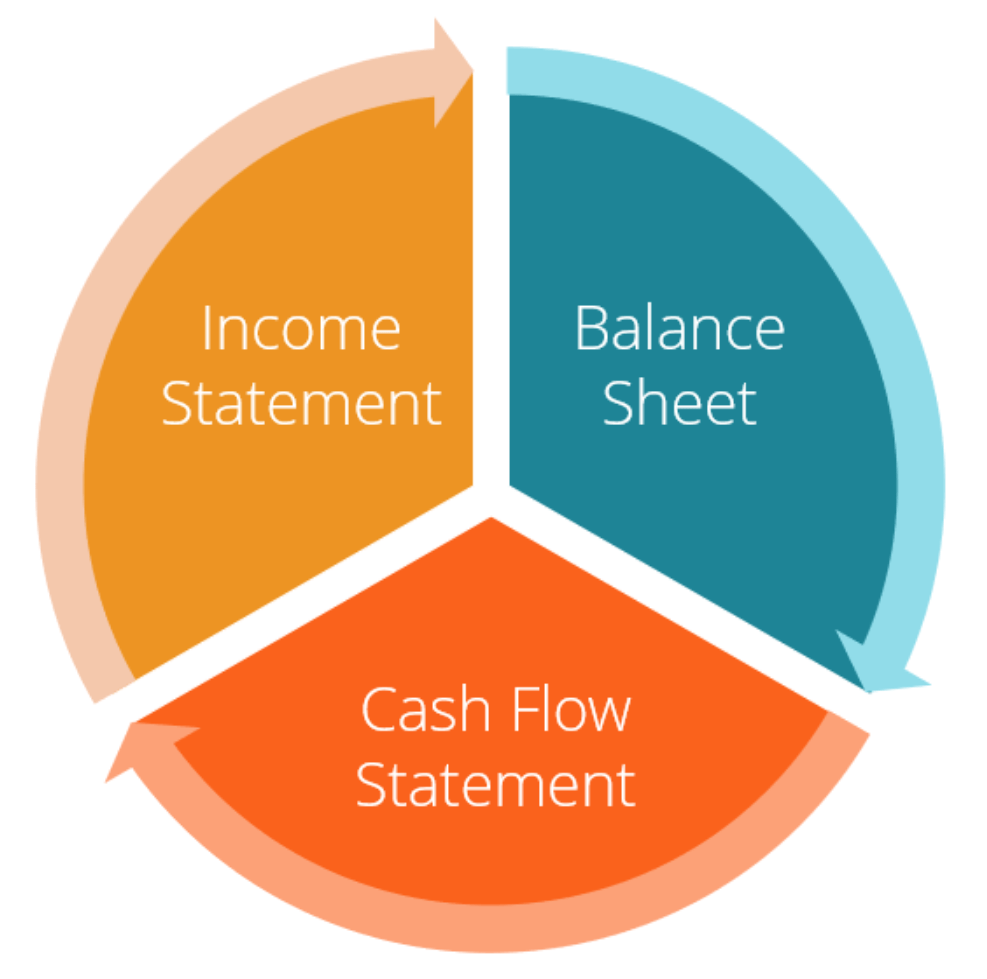

To use the formulae presented below, one must access basic annual accounting declarations or financial statement information apprising an organisation’s health. The financial metrics listed in the attachments below provide various industry-specific metrics or indicators used to advise on an organisation’s performance, including its competitiveness and shareholder attractiveness compared to similar-sized firms.

Financial perspectives:

- Profit ratios, i.e. sales and revenue growth, gross profit margin, EBIT or EBITDA margin, margin attributable to stakeholders, labour and sales ratios, ROCE and ROE;

- The use of assets and gearing, i.e. asset turnover indicators, debt, equity and gearing indicators;

- Investor ratios, i.e. earnings per share and earnings per share growth, dividends per share, dividends growth, dividends yield and the price per earnings;

- MVA, EVA, TSR, i.e. market value-added, market value added per year, economic value-added, total shareholder retention ratios, new dividends per share price and overall shareholder retention;

- Cash-based ratios, i.e. EBITDA, cash EPS and cash ROCE.

Downloads:

- Essential formulae for managing financial value drivers

- An infographic showing important formulae for managing economic value drivers

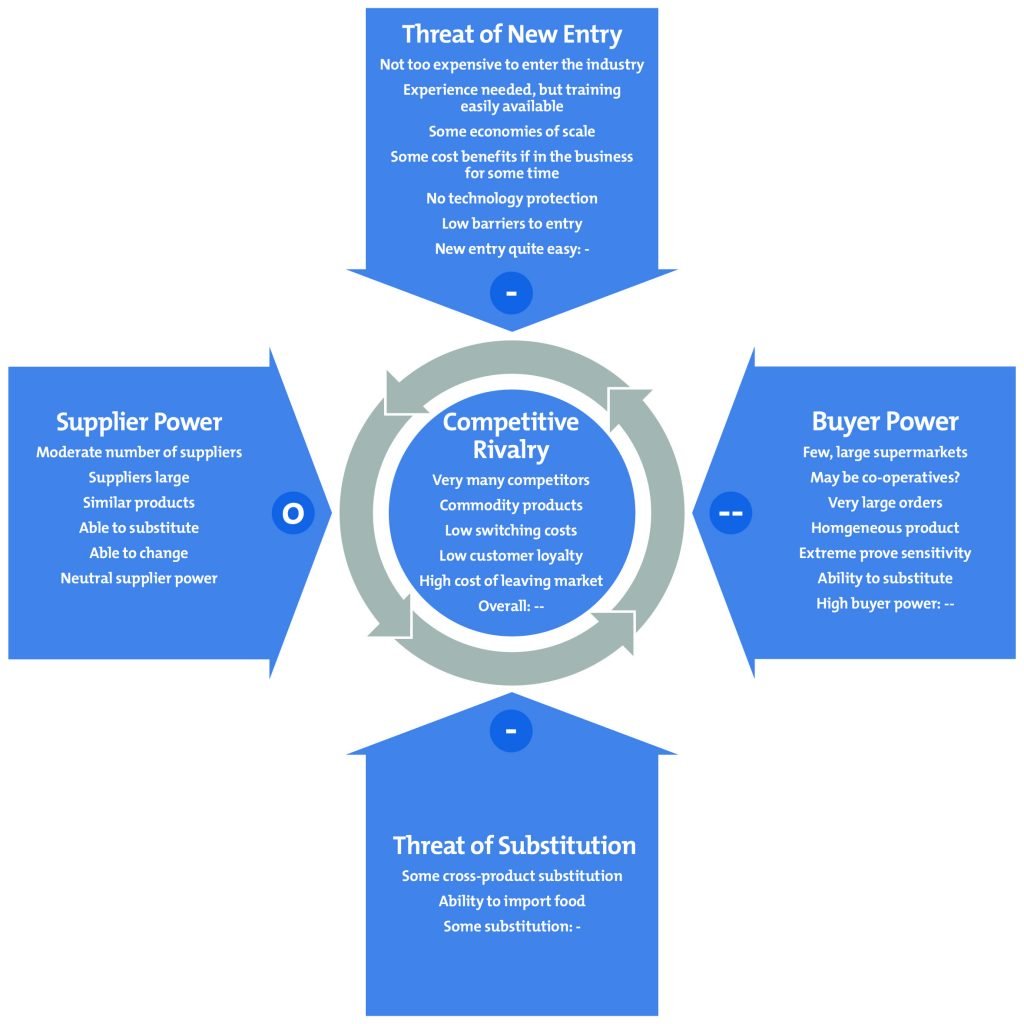

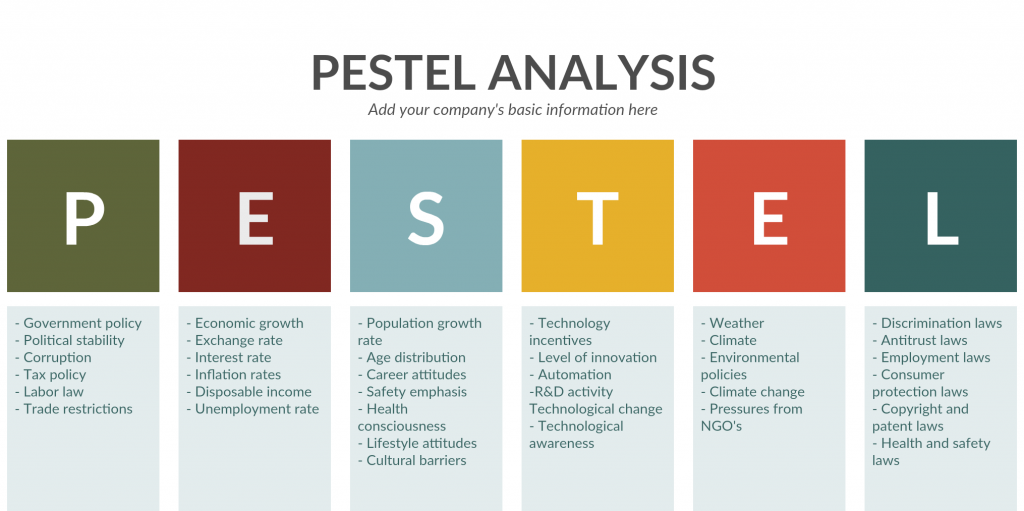

I argue that organisations are fluid and constantly respond to external factors reshaping how firms operate. To monitor these interactions, one can use specialised financial drivers and metrics. These indicators also help predict an organisation’s response to PESTLE environmental forces to help a business grow and influence its development.

One can use annual statements or information any appointed accountant will have sight of as inputs into the attached formulae. Once the input values complete the equations, the outputs will generate standardised results that the corporate finance community will recognise and associate with long-term value principles. In doing so, one might benchmark similar-sized organisations against standardised performance metrics.